The story of Marta and Chiara: an example of Inser’s best practice in insurance for travellers abroad

The Story of Marta and Chiara: an example of Inser’s best practice in insurance for travellers abroad

When you decide to travel abroad, it is essential to have adequate insurance coverage for the specific needs of your trip. To explain why, we will tell the story of Marta and Chiara (the names are fictional), two Italian girls who lived a difficult experience in Nicaragua and how Inser intervened decisively to ensure their safe return to Italy.

Sometimes traveling abroad involves risks and challenges that can vary greatly depending on your destination and planned activities. For this reason, it is essential to have a competent expert at your side to ensure the tranquility and safety of travelers, sure to be protected in case of unexpected events.

The story of Marta and Chiara

Marta and Chiara, two brave Italian girls, decided to go to Nicaragua for a period of time as volunteers for Doctors Without Borders. Before the departure they had taken out travel insurance directly with a tour operator, who often does not have the same technical skills as an insurance broker experienced in the field. During their stay they found themselves in a difficult situation when they were involved in a serious road accident.

The accident forced them to go to a local hospital, where they faced challenges related to the quality of health compared to Italy. However, the main problem was repatriation in a short time, an emergency given the seriousness of the health conditions. The insurance coverage available to them did not provide assistance for a quick return to Italy, thus creating a further complication.

It is in this situation that Inser, thanks to the experience of its international insurance experts for those traveling abroad, has managed to organize the repatriation of Marta and Chiara in just three days.

The role of Inser Spa and the experts in the insurance industry

The story of Marta and Chiara clearly shows how essential it is to rely on a competent insurance consultant when traveling abroad.

Thanks to our extensive experience in the international travel insurance industry, we are able to ensure the protection and tranquility of our customers with a wide range of tailored policies that include medical emergency guarantees, accidents, cancellation of the trip, loss or theft of luggage and different other.

Relying on an experienced and specific team, even more if you travel to distant countries, can make the difference for a timely solution of the problem.

News

Parametric insurance, new frontier of insurance

Parametric insurance, new frontier of insurance

Parametric policies represent an innovative form of insurance that offers coverage based on specific, predefined and measurable parameters.

It is a solution offered by Inser Spa, which differs from traditional policies because it determines the payment based on the occurrence of a specific natural event, or the achievement of a predetermined threshold.

Concrete examples of use

For an event to be considered eligible as an insurable trigger, it must be fortuitous, or outside the policyholder’s control. This means that the event must be objectively measurable and verifiable, so as to ensure transparency in the determination of compensation.

How the insurance works

Benefits for insured persons

The role of Inser

News

Cyber Risk Management: a Partnership Journey to Enterprise Security

Cyber Risk Management: a journey of partnership towards corporate security

In the digital age, the risk of suffering a cyber attack is an unavoidable reality for both companies and people; every day we are exposed to threats that seriously endanger our security and, above all, our well-being.

The latest statistics state that hackers can hack corporate systems at 93%, because of their extreme vulnerability; small and medium-sized enterprises are the most affected and fragile realities; the block of the activity turns out to be one of the more considerable damages for a company that makes of the time one precious resource. Other data state that SMEs are not able to defend themselves against a hacker threat, nor to recover from the financial damage suffered, and, despite this, most companies have not yet purchased insurance coverage that offers adequate cyber risk protection.

The insurance market used to be limited to suggesting but today it demands the active participation of the company in risk management.

Thus, in an evolving world threatened by real and new risks, it becomes essential to undertake a corporate path, first of all of analysis and study of their vulnerabilities, in a second moment of protection and defense through the weighted insurance transfer able to guarantee corporate welfare and cyber security.

The great journey to cybersecurity

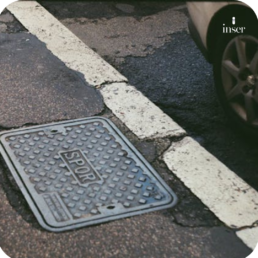

If you think about it, it’s exactly like this: a motorist prepares for the long journey with in his hand the precise and detailed map that indicates the current location, the destination to reach and the road to go. The map is the fundamental tool to understand how many kilometers have to be made, if you have adequate resources and, consequently, if you have to vary the route.

Things, people, safety: the right way

Based on our decades of experience, we endorse what has been said: against cyber risk the insurance solution is only the last stage of the great journey, extremely important, but what matters is the path that together we will take. The three milestones of the coast to coast are called "things", "people" and "security".

The first concerns the improvement of company hardware and software, because the protection of digital resources is essential to counter external threats; the second, people, requires special attention to staff training: Being aware of your assets and human resources means you have a great advantage over cyber threats, so it’s critical to update employees on phishing techniques and raise awareness about cybersecurity. Finally, the last and most important stage, safety: it implies the conscious and necessary transfer of residual risk to insurers. As we said, it is the last leg of the journey, the one that at the end of the coast to coast will bring us to our destination, our safe haven. Keep in mind: things, people, security are the necessary formula against every cyber threat.

La partnership con Inser e il risk managment

We are aware that every travel destination, with time, turns into the initial stage of a subsequent, you must always be ready to start again, to get back into the game by updating our hand luggage on the basis of previous experiences. let's do it together.